How Opportunity Zones can help transform our community

This week, Congressman Patrick McHenry (R-10) visited our Board of Directors meeting to share a pivotal business opportunity that has emerged from the recent Tax Cuts and Jobs Act of 2017. Rather than paying the traditionally high taxes on unrealized capital gains, investors now have the option to reinvest these gains into certified “Opportunity Zones” and depending on length of investment, either defer or permanently waive these taxes.

This week, Congressman Patrick McHenry (R-10) visited our Board of Directors meeting to share a pivotal business opportunity that has emerged from the recent Tax Cuts and Jobs Act of 2017. Rather than paying the traditionally high taxes on unrealized capital gains, investors now have the option to reinvest these gains into certified “Opportunity Zones” and depending on length of investment, either defer or permanently waive these taxes.

“The economic development opportunities are real, and the ways this tax provision can transform our community are vast,” said McHenry. “Asheville is one of the best positioned communities in North Carolina to create a fund for these kinds of projects….We hope to be a national example of how to do this.”

At the Chamber, we see this new policy as a great opportunity to revitalize our community, create jobs, and encourage economic development. Here’s a breakdown of what determines an opportunity zone, where they are in Asheville, and how to take advantage of this new investment opportunity.

What is an opportunity zone, and how are they determined?

Opportunity Zones were created to encourage growth in low-income and rural communities across America by providing a tax incentive for private investors to make long-term investments in communities who face economic hardships. To qualify as an Opportunity Zone, an area must have a poverty rate of 20% or higher OR a median household income that is less than 80% of the surrounding area. Asheville’s Opportunity Zones were determined by the City in conjunction with the Governor and Department of Commerce.

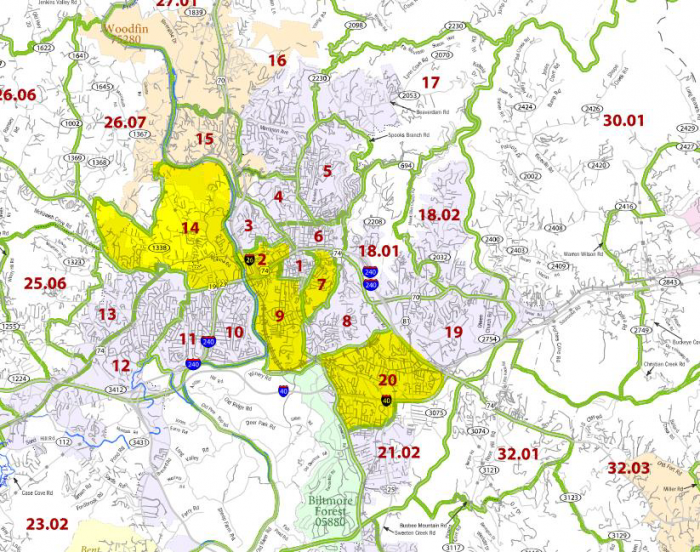

Where are they in Asheville?

There are 252 in the state, and 5 in Asheville. Many are residential areas, but zones also include the River Arts District and the South Slope border. (See map)

What is the investment process?

In order to invest in opportunity zones, the gains must be placed in an “Opportunity Fund.”

So long as these funds remain invested, taxation is temporarily deferred. If these gains remain invested in opportunity zones for ten years, then the capital gains tax is waived. (If you have more questions on how this works, check out PWC’s publication.)

What is an Opportunity Fund?

Opportunity Funds are built to be responsive to the community’s needs, allowing for investment in operating businesses, equipment, and real property. It can be structured as a corporation or partnership, and must be dedicated to small business investment or economic development. Funds can be created by a wide variety of investors, including large banks, venture capital groups, and regional economic development organizations. To create a fund, an eligible taxpayer can self-certify by filing a simple form with their annual federal income tax return.

What positive economic development can we expect?

This new provision is a significant opportunity for investors to promote growth within our region’s struggling communities, while simultaneously providing tax savings to investors. It has great potential to create more jobs in the community and assist our economic development team in recruiting high-quality companies to our region.

At the meeting, Mayor Esther Manheimer also suggested this could support our mission of expanding affordable housing options, saying Asheville is in a good position to leverage this opportunity to its fullest.